Correlation between re-rating & incremental performance

Correlation between re-rating & incremental performance

What is re-rating?

Increase in the value of the business as compared to the past because of better future prospects.

First let’s understand what re-rating means-Let’s take an actual example of a company called Tips

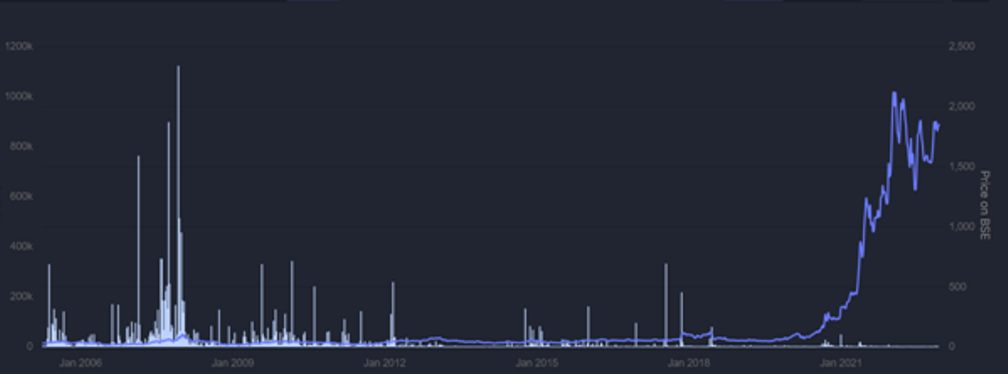

industries, a music licensing company. Below is a 16-year price chart of Tips:

The stock didn’t move at all for 15 years, what changed in Jan ’21 that a stock priced at 170Rs, in

almost 2 years became worth 2000rs, a 10 bagger in 2 years?

Till Jan ’21, monetisation of music catalogue wasn’t discovered as such, but when it was discovered

the promoters and the investors found that incrementally the music catalogue of Tips has more

value as compared to before Jan ’21. Before this discovery, money was made on this catalogue using

the traditional way which had lower growth & return on capital, but after discovering the digital way

of monetising, the incremental growth lever & the return on this catalogue was far more than the

traditional way of making money on music. Incremental growth, return on assets/capital was much

more than that of previous times, hence market started valuing the stock/company more.

Advantages of finding re-rating opportunities:

The inventor gets benefitted in 3 ways:

a) Higher future growth rate of earnings

b) Increase in value for the business-Since the business is now incrementally valued more by

the investors, so this brings a multiplier effect

c) Limited downside-Since earlier the company wasn’t valued very highly, the downside is

limited hence this reduces the risk of stock price to fall drastically further

It is very tough to find such rare opportunities in the market, you have to keep your eyes and ears

open all the time to spot such an opportunity, but if you do, the upside potential is way too high.

Now let’s take an example of a stock whose story hasn’t changed incrementally which is reflected in

the stock price:

This is Colgate’s stock price chart, the stock has moved from 200Rs to 1600Rs in 16 years, the

increase in stock price is in line with its increase in earnings, there was never a point during which

there was a re-rating situation in Colgate because there was no substantial incremental change in

the business model which would change the value of the business suddenly, which also means the

stock was always fairly valued. The story of the company has always been the same, selling

toothpaste which is fully penetrated in India and there is no substantial incremental growth.